Credit Risk Evaluator ML Model

End-to-end credit risk scoring system aligned with real-world financial standards

Domain / Function

Finance, Risk Analytics & Machine Learning

Project Overview

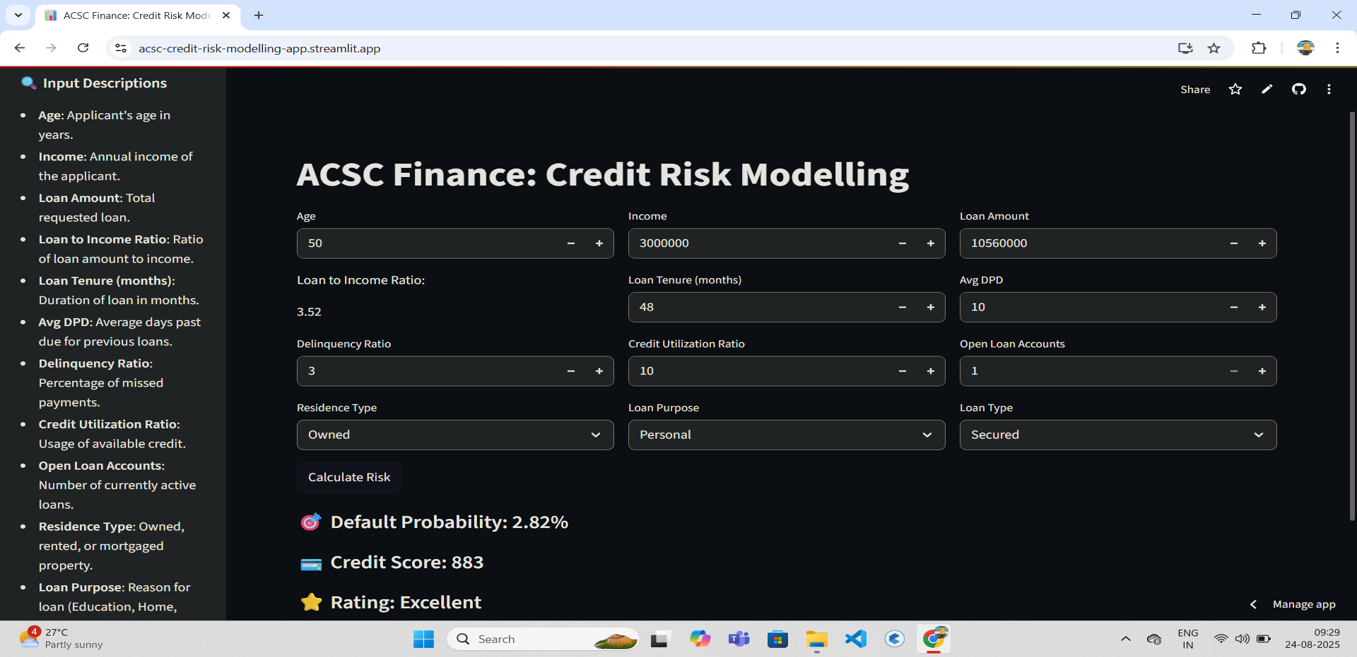

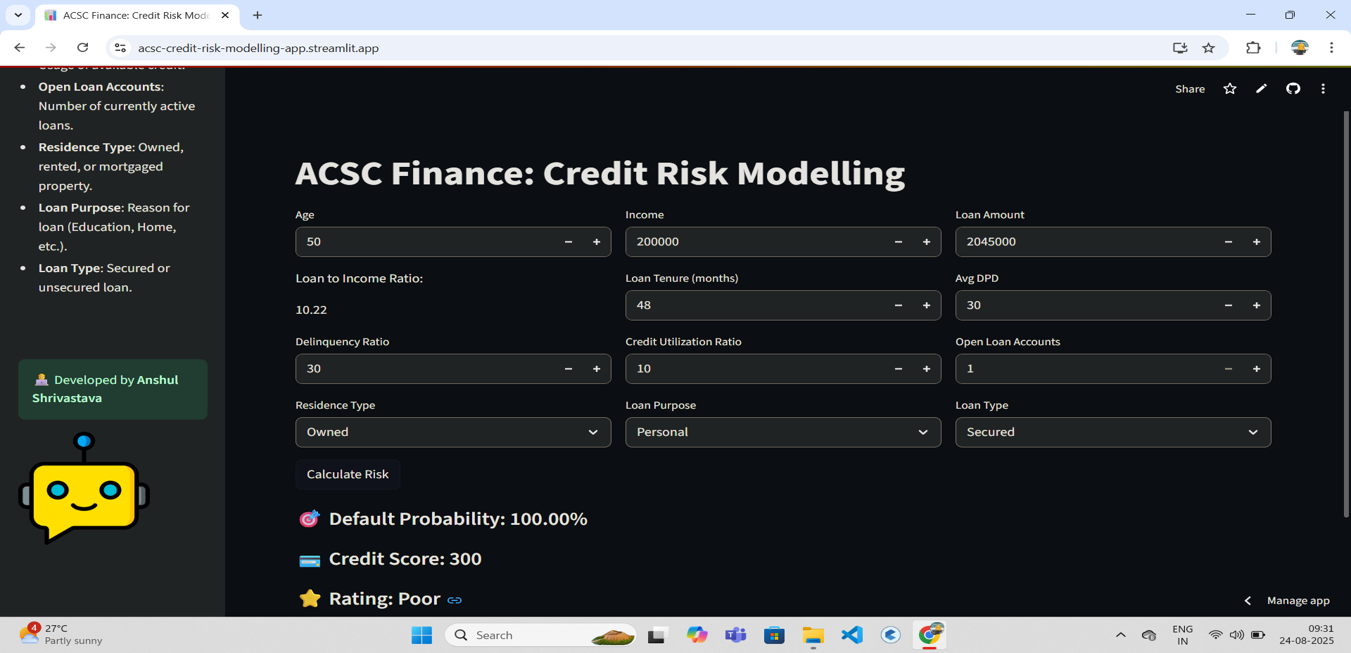

Built a complete Credit Risk Evaluation System that predicts and classifies loan applicants into Poor, Average, Good, and Excellent risk categories, inspired by industry-level credit scorecards such as CIBIL.

The system processes customer, loan, and bureau data, performs extensive preprocessing, feature engineering, model training, and delivers real-time predictions through an interactive Streamlit web application.

Key Features

- Credit scorecard-based risk classification

- End-to-end ML pipeline from data cleaning to deployment

- Feature engineering using financial ratios

- Class imbalance handling using SMOTE-Tomek

- Hyperparameter tuning with Optuna

- Real-time prediction using Streamlit UI

Project Details

Multiple ML models including Logistic Regression, Random Forest, and XGBoost were trained and evaluated. The final model achieved excellent performance with a Peak KS score of 85.70, demonstrating strong separation between good and risky borrowers.

This project simulates real-world banking workflows and can be extended for loan approval, risk monitoring, and financial decision automation.