AtliQo Bank Credit Card Analytics

Target market identification and A/B testing for a new credit card launch

Domain / Function

Banking Analytics & Business Intelligence

Project Overview

This project analyzes customer transaction and credit data to identify the most profitable and credit-ready customer segment for launching AtliQo Bank’s first credit card in the Indian market.

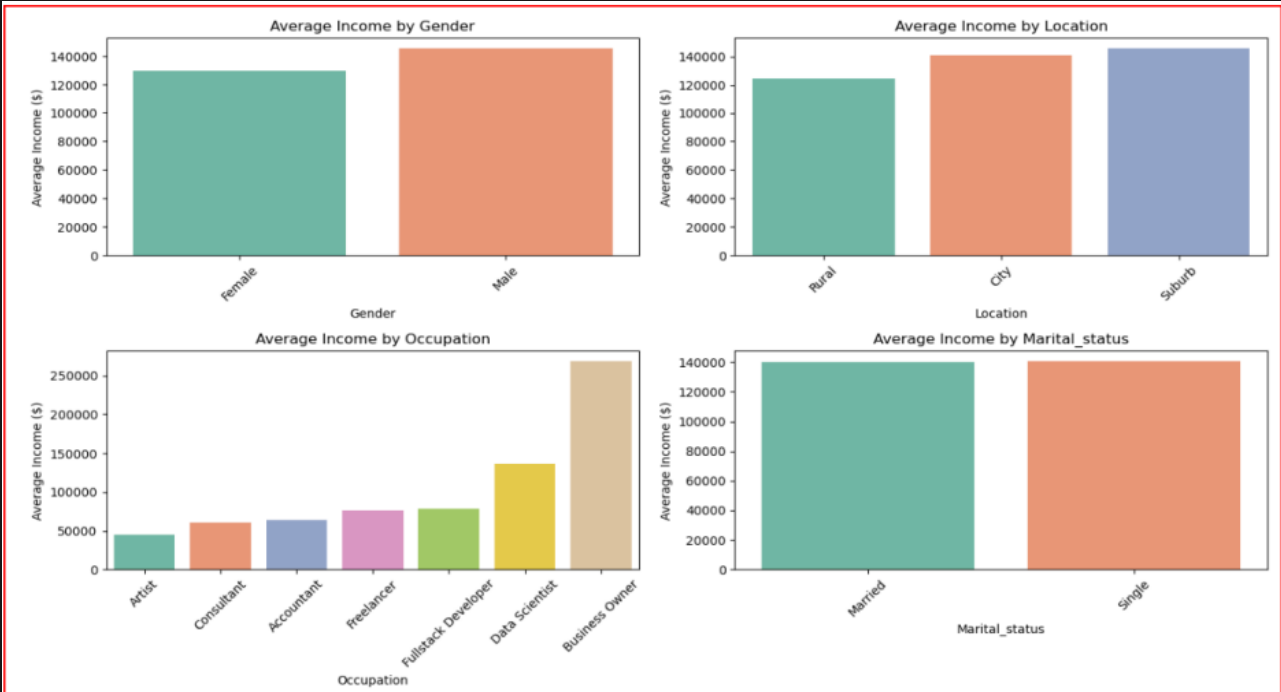

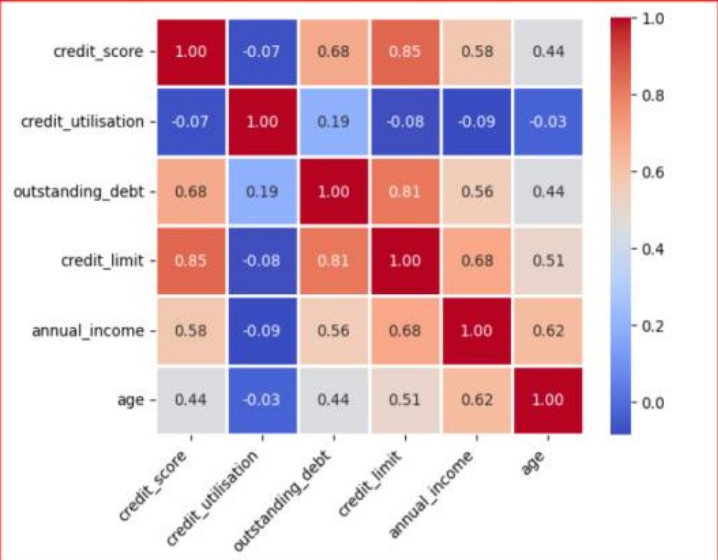

Exploratory Data Analysis (EDA) was performed on income, age, spending behavior, and credit scores, followed by A/B testing to validate the effectiveness of the proposed targeting strategy.

Key Features

- Customer segmentation using demographic and financial attributes

- EDA on income, spending patterns, and credit scores

- Payment method and platform behavior analysis

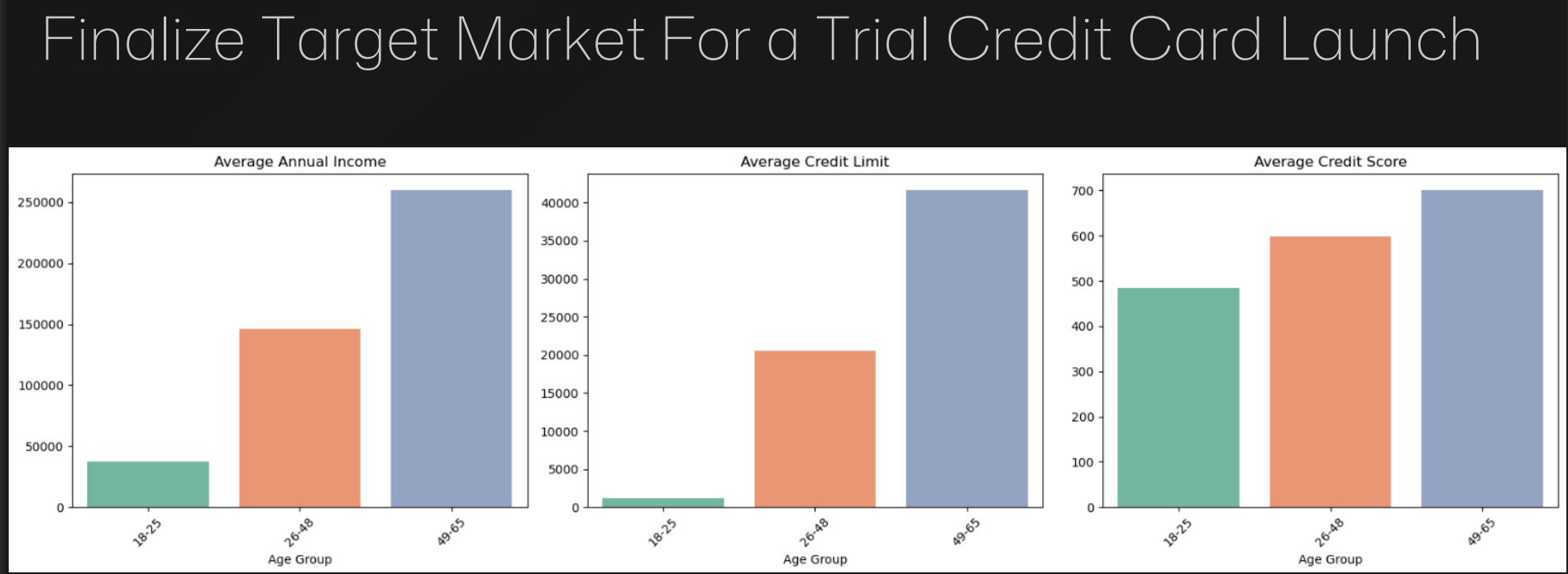

- Target customer identification for credit card launch

- A/B testing and hypothesis validation

- Business-ready insights for decision making

Project Details

The 26–48 age group was identified as the highest potential segment, showing stronger income levels, higher transaction volumes, and better credit usage. A/B testing results showed statistically significant improvement in transaction amounts for the test group, validating the targeting strategy.